Suzhou Property Market Research Report

Executive Summary

1. Overview of Suzhou development context

Suzhou is positioned as the national historical and cultural city and scenic tourism city, the national high-tech industrial base, and one of the important central cities of the Yangtze River Delta. Based on PEST analysis, Suzhou has strong economic strength and attractiveness of the population in the whole country.

2. Performance of Suzhou property market

The growth rate of property investment is slow down and the environment for foreign investment is not positive during recent years. The indicators of investment effect and ROI all indicate a trend of higher risk for property development. Although it shows that the demand exceeds the supply, the market tends to cool down in recent years.

3. Status, characteristics and potential of sub-markets

The residential building market tends to be stable after a rapid growth and the overall situation is that supply falls short of demand (except Kunshan); The commercial property market is overheating, especially in Kunshan and Wujiang, and suffers the pressure of inventory; The office building market has a tendency of over-saturation after a boom, especially Kunshan.

4. Influential factors to market trends and opportunities

For the policy environment, both national and local governments are intensifying regulations on real estate market in 2019, while SIP published the documents to improve the environment of foreign investment. In terms of economy, Suzhou has a positive future vision based on a series of development plans, but it is also under the risk of potential international economic instability. In a social aspect, the policies for attracting talents are issued by both national and local governments.

5. Recommendations

The sub-market suggested to invest is residential building in SIP and it may be suitable to enter the market in the next few months. Attention should be paid timely to policy adjustment during and after the period of construction, about six years.

1. Overview of Suzhou development context

Suzhou is located at the centre of the lower Yangtze River Delta (Figure 1). With a history of more than 2500 years, it has been transformed from a famous historical national commercial city into a modern industrial city in contemporary China (Wang, Shen & Chung, 2015). Besides the central city proper, the Suzhou government manages five county- level cities, namely Wujiang, Changshu, Zhangjiagang, Kunshan and Taicang.

1.1 City positioning

According to ‘Suzhou City Master Plan (2040)’, Suzhou is positioned as the national historical and cultural city and scenic tourism city, the national high-tech industrial base, and one of the important central cities of the Yangtze River Delta (The State Council, 2016). In ‘Urban System Planning of Jiangsu Province (2015-2030)’, there will be two megacities in Jiangsu province, namely Nanjing (provincial capital) and Suzhou (Jiangsu Urban & Rural Planning, 2015).

Yaping Li (CSCF, 2017), Deputy Party Secretary of Suzhou, stated that the development of Suzhou should actively connect with the national strategy of ‘One Belt One Road’, and construction of Yangtze River economic belt and urban agglomeration. Suzhou is strengthening the cooperation with surrounding cities and actively participating in the construction of world-class city clusters. By taking advantages of Shanghai, Suzhou has experienced several rapid development phases. The Shanghai-Nanjing Intercity Railway has shortened the distance between Suzhou and Shanghai to less than 20 minutes, and the planning of line S1 of Suzhou-Kunshan InterCity Express also accelerates the urban integration between two cities. Suzhou is an important railway hub in the Yangtze River delta and a trans-provincial transportation centre.

1.2 PEST Analysis

1.2.1 Political Factors

1.2.1.1 National Level

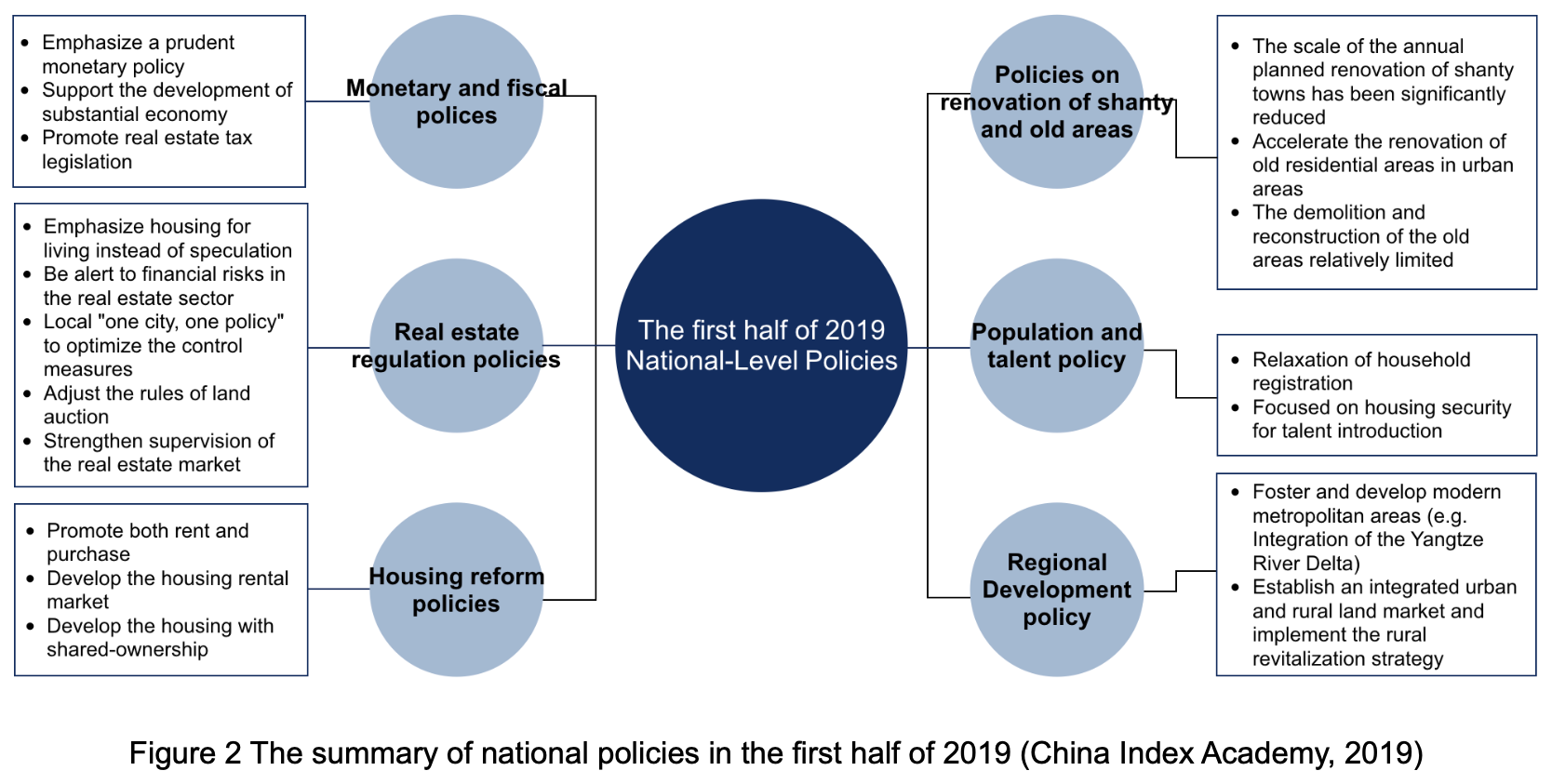

In the first half of 2019, the central government has launched a series of policies influencing the property market (Figure 2). The new policies in 2019 have strengthened efforts to realize diversified housing supply, effectively meeting the housing needs of different groups.

1.2.1.2 Municipal Level

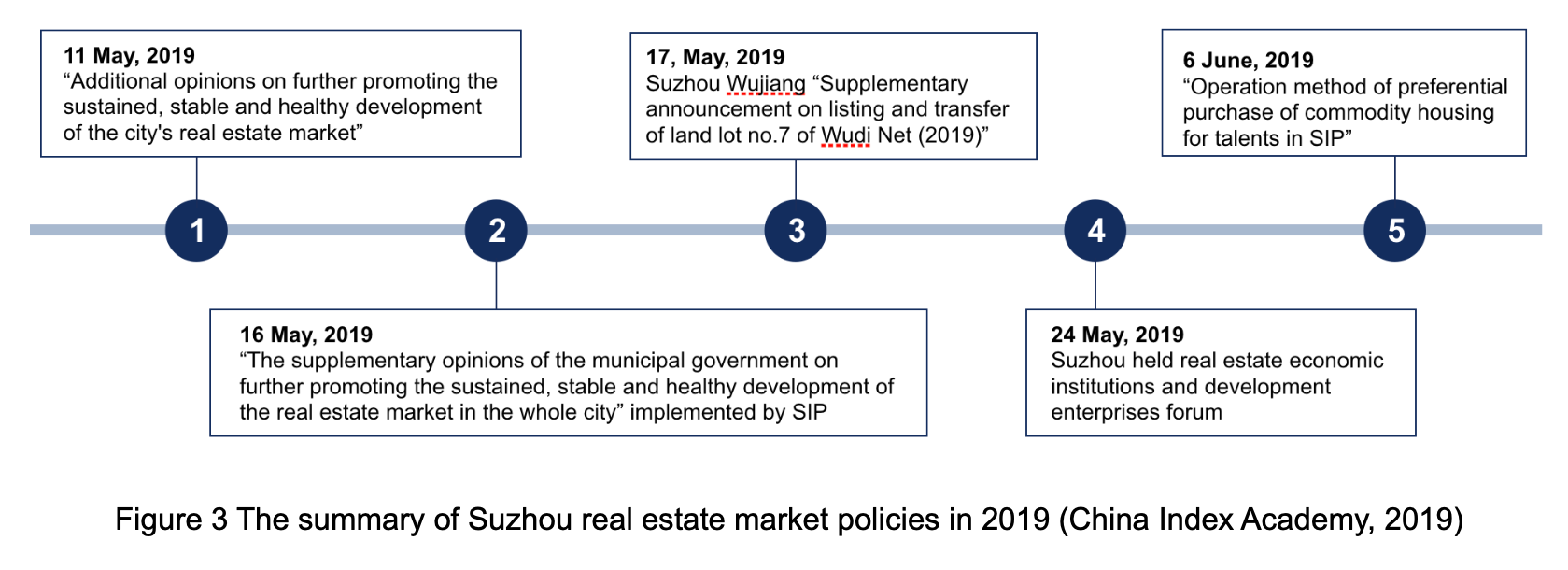

In May, the Ministry of Housing and Urban-Rural Development issued a warning to Suzhou due to a large increase in the price index of new and second-hand residential buildings. Subsequently, Suzhou issued a series of optimized control measures (Figure 3), including the adjustment of land transfer conditions.

1.2.2 Economic Factors

1.2.2.1 Gross Domestic Product (GDP)

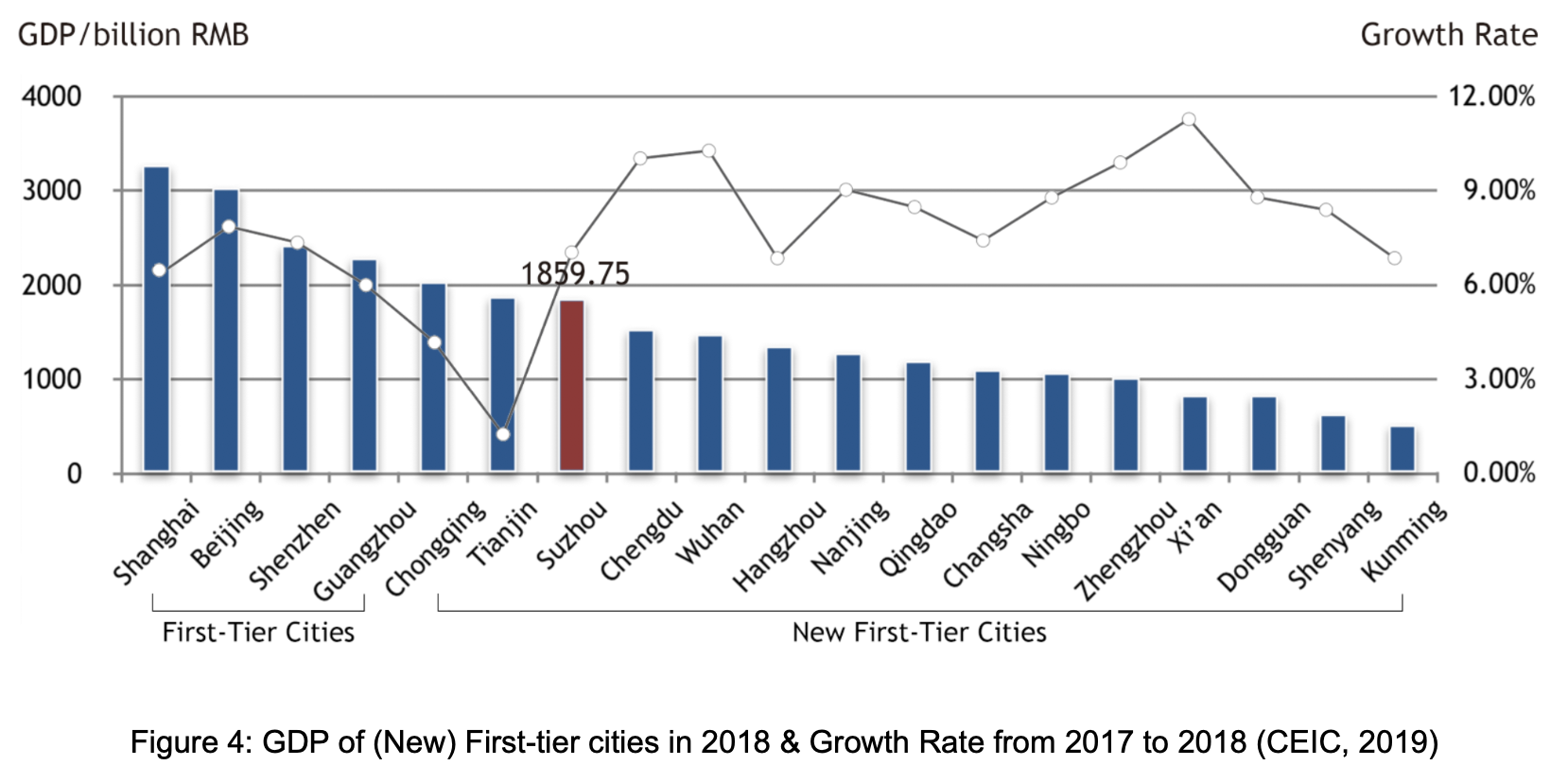

- GDP of Suzhou in 2018 was ranked seventh overall in the nation and ranked third in the new first-tier cities, published by China Business Network (CBN, 2019) (Figure 4).

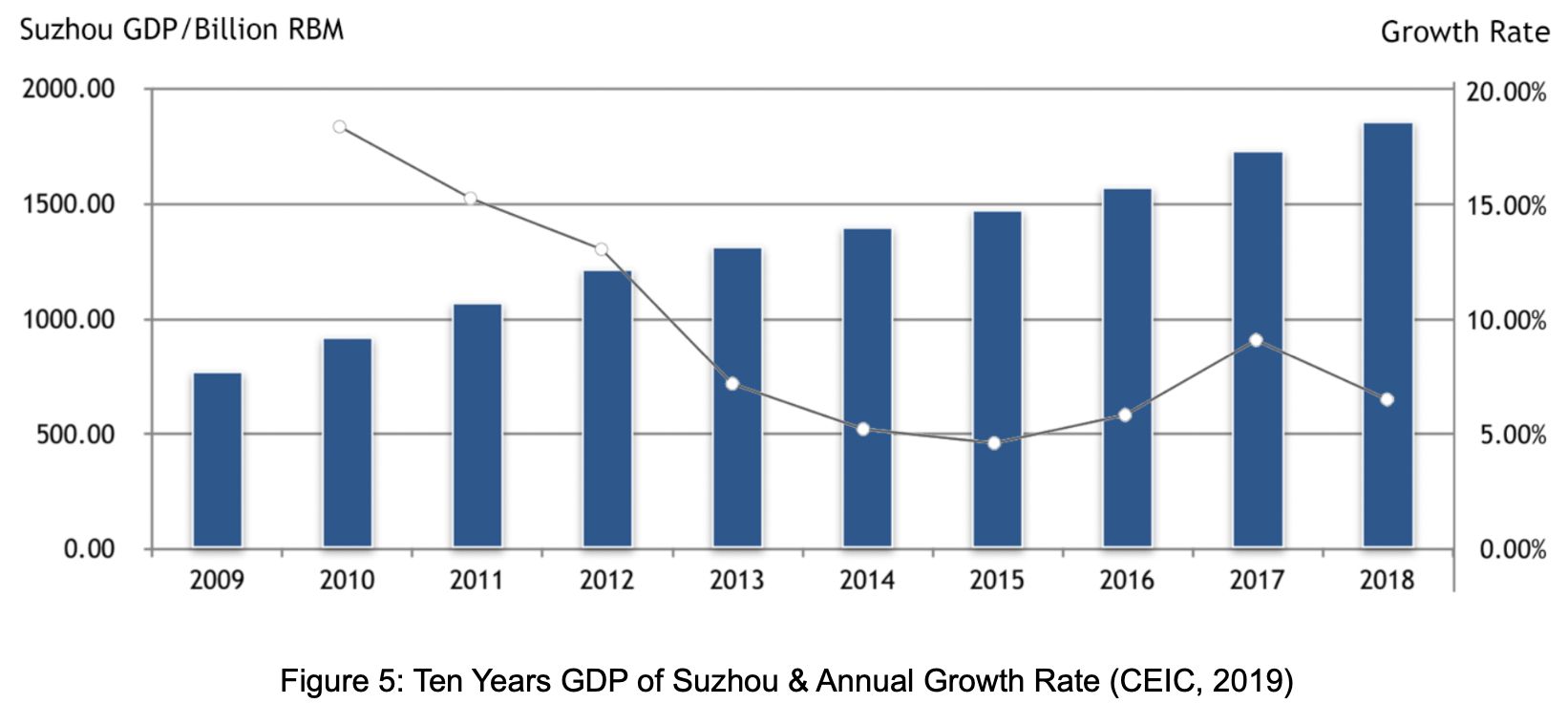

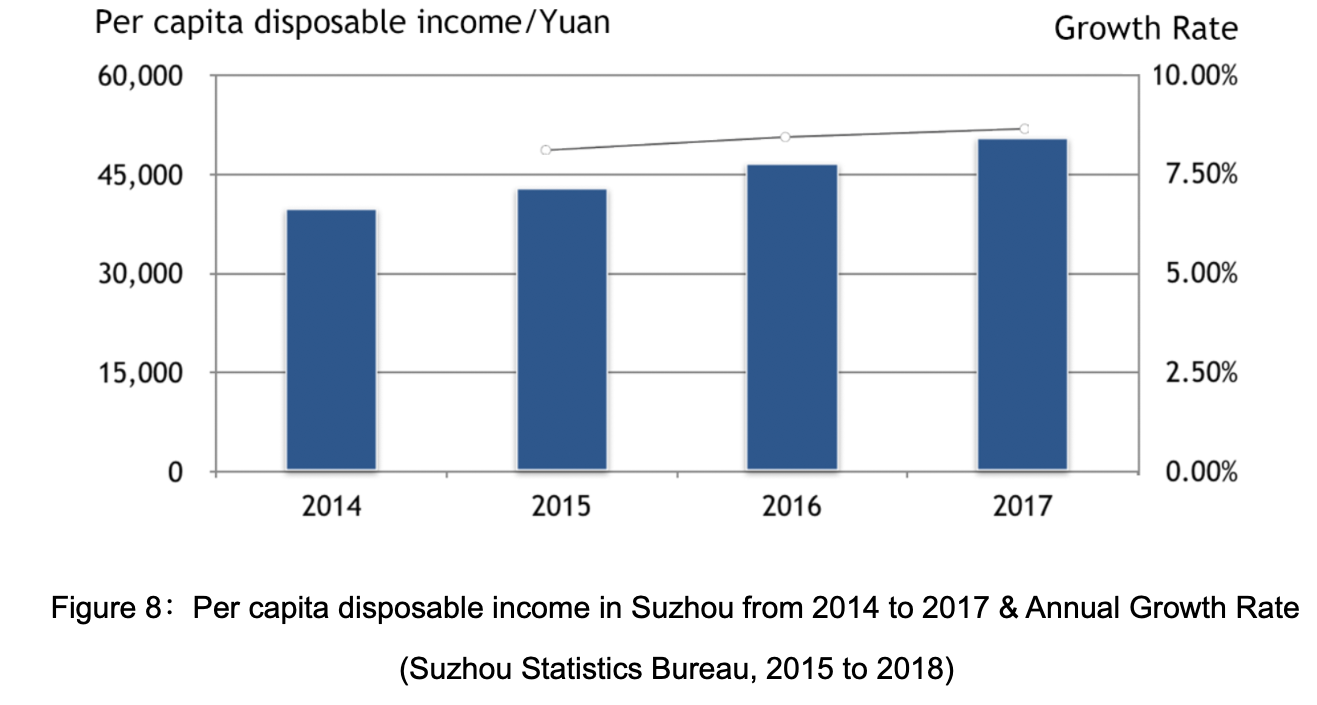

- Suzhou has sustained GDP growth during the last ten years, while the growth rate is decreasing (Figure 5).

1.2.2.2 Per Capital Index

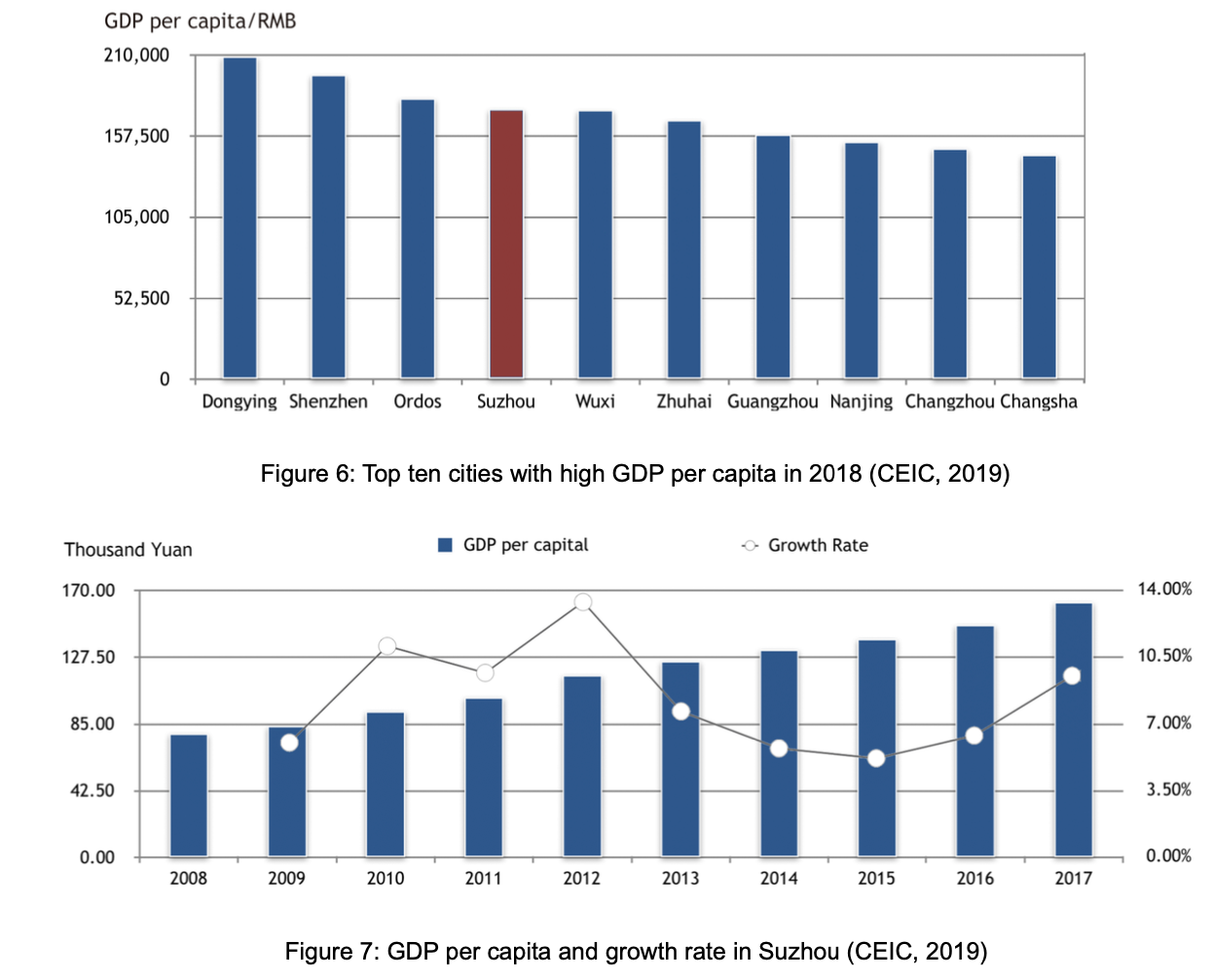

- GDP per capita in Suzhou was ranked fourth in the nation in 2018, which indicated a high welfare level of people and purchasing power (Park, Ryu & Lee, 2019).

- The per capita disposable income in Suzhou is increasing stably by 8% annually.

1.2.2.3 Property Investment

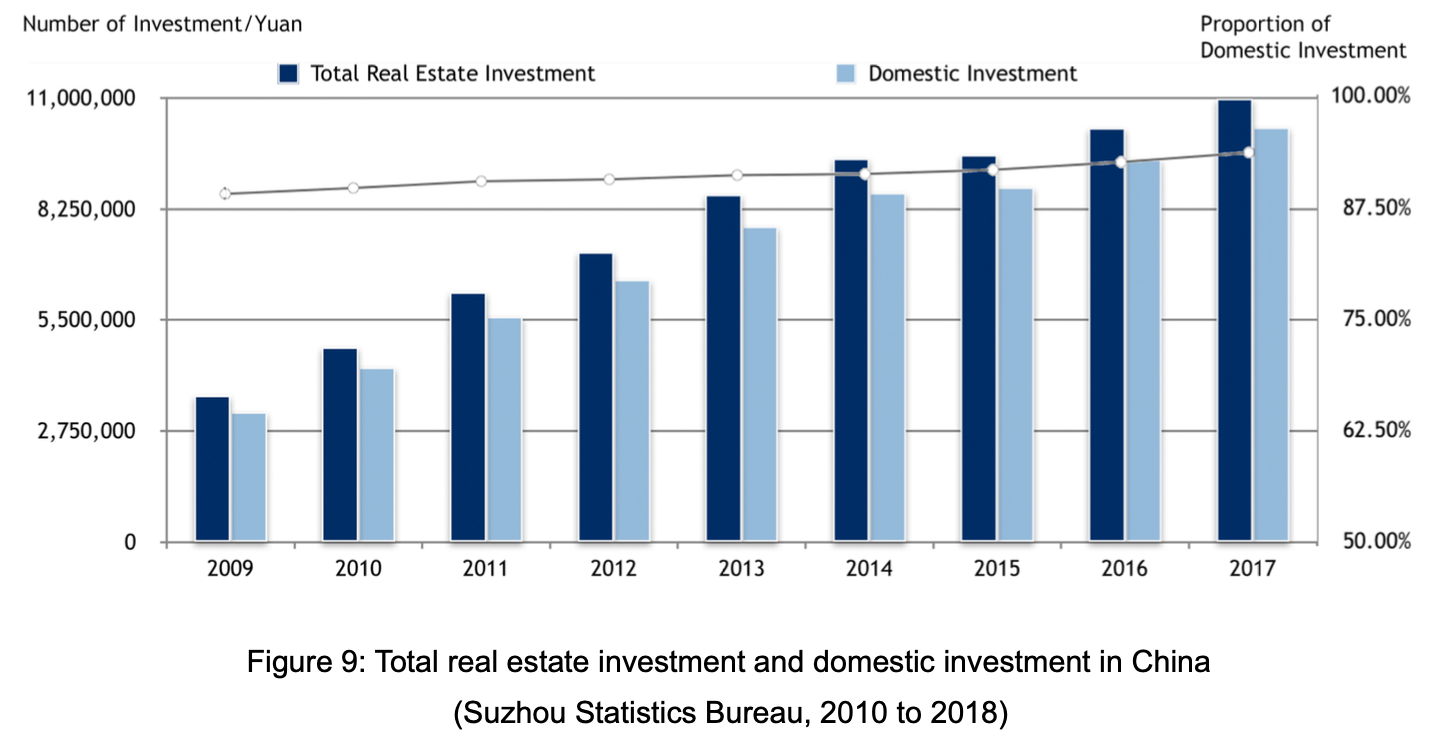

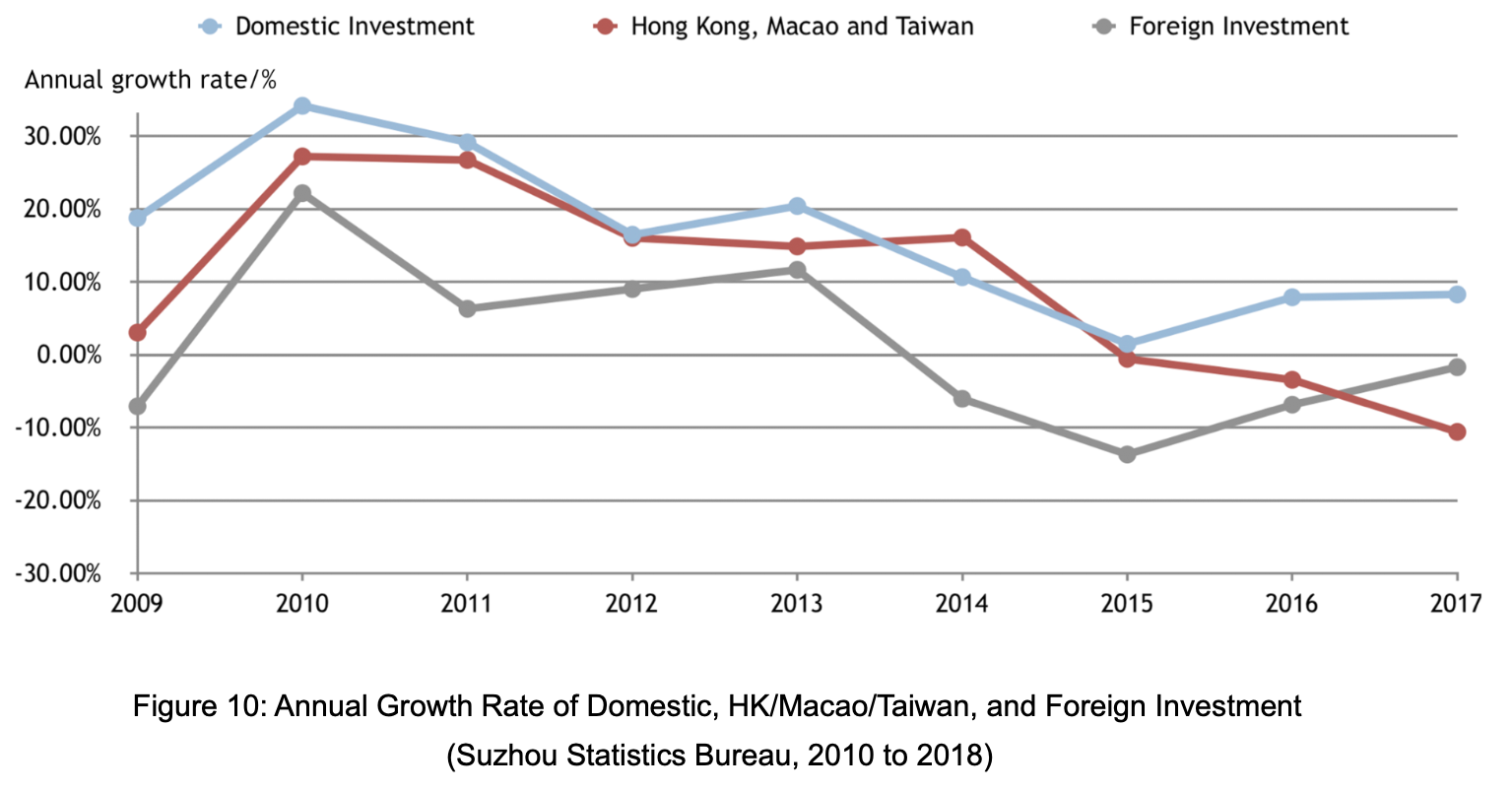

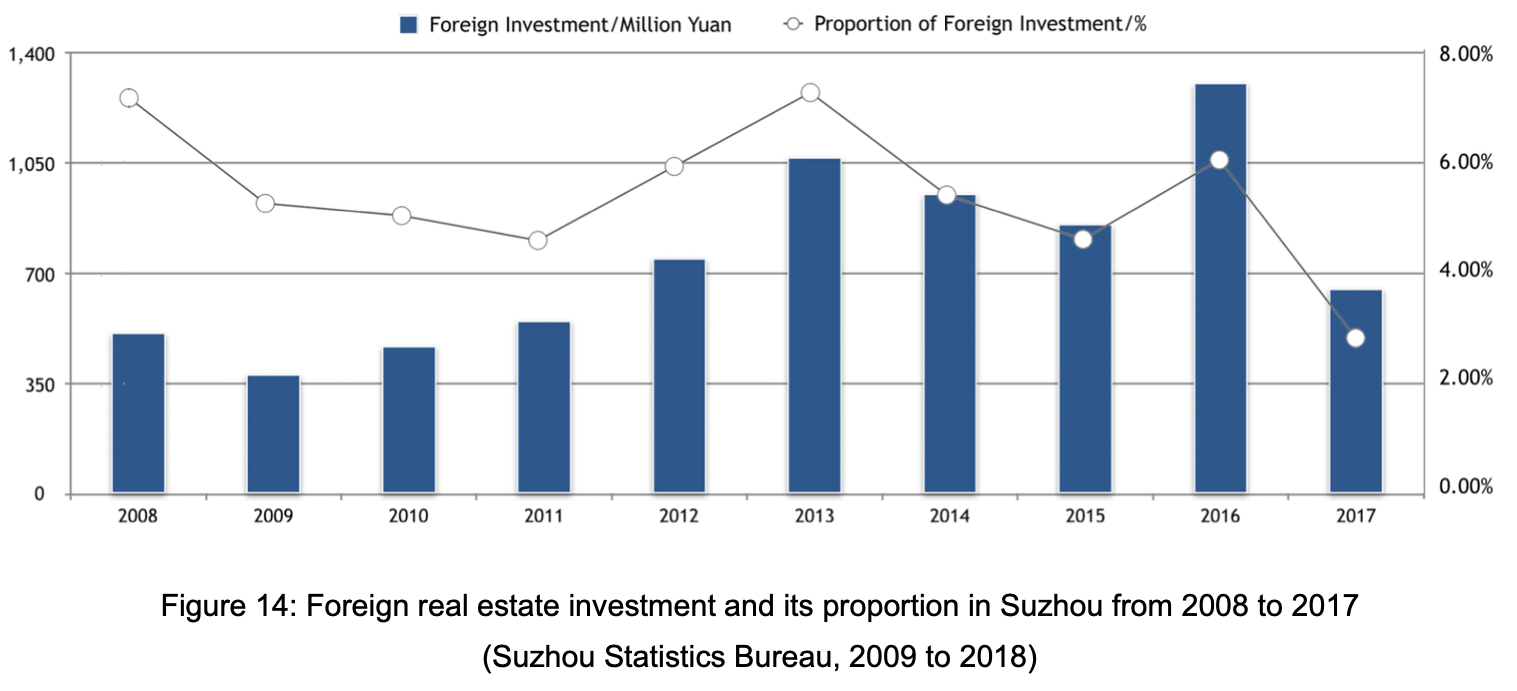

- Domestic investment plays a dominant role in real estate investment, and the proportion is slightly increasing.

- The general growth rate of estate investment is decreasing.

1.2.3 Social and Cultural Factors

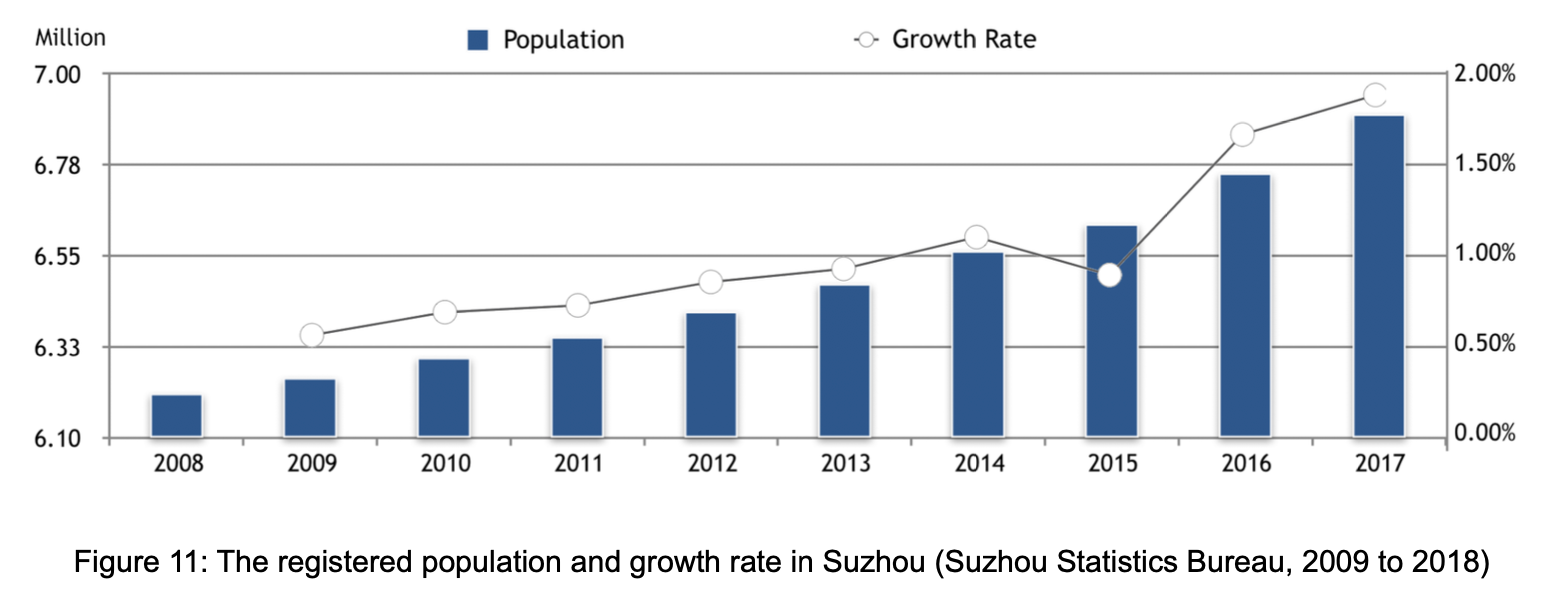

- Suzhou has a strong attractiveness of population with an increasing growth rate.

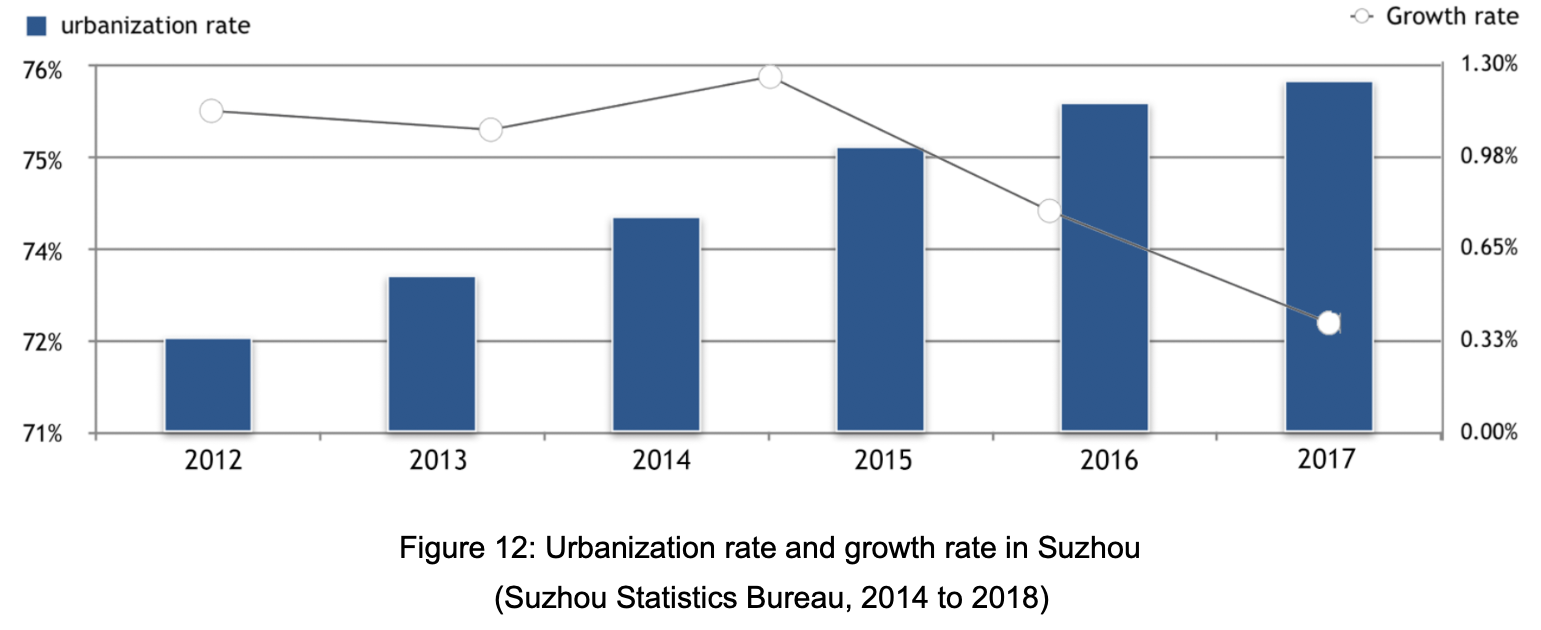

- Suzhou has a high urbanization rate, while the growth continues to slow.

1.2.4 Technological Factors

- People’s demand for real estate products is individualized and modernized, and it is developing towards the direction of green, environmental protection, energy-saving and intelligent (Qi, 2012).

2. Performance of Suzhou property market

2.1 Property Investment

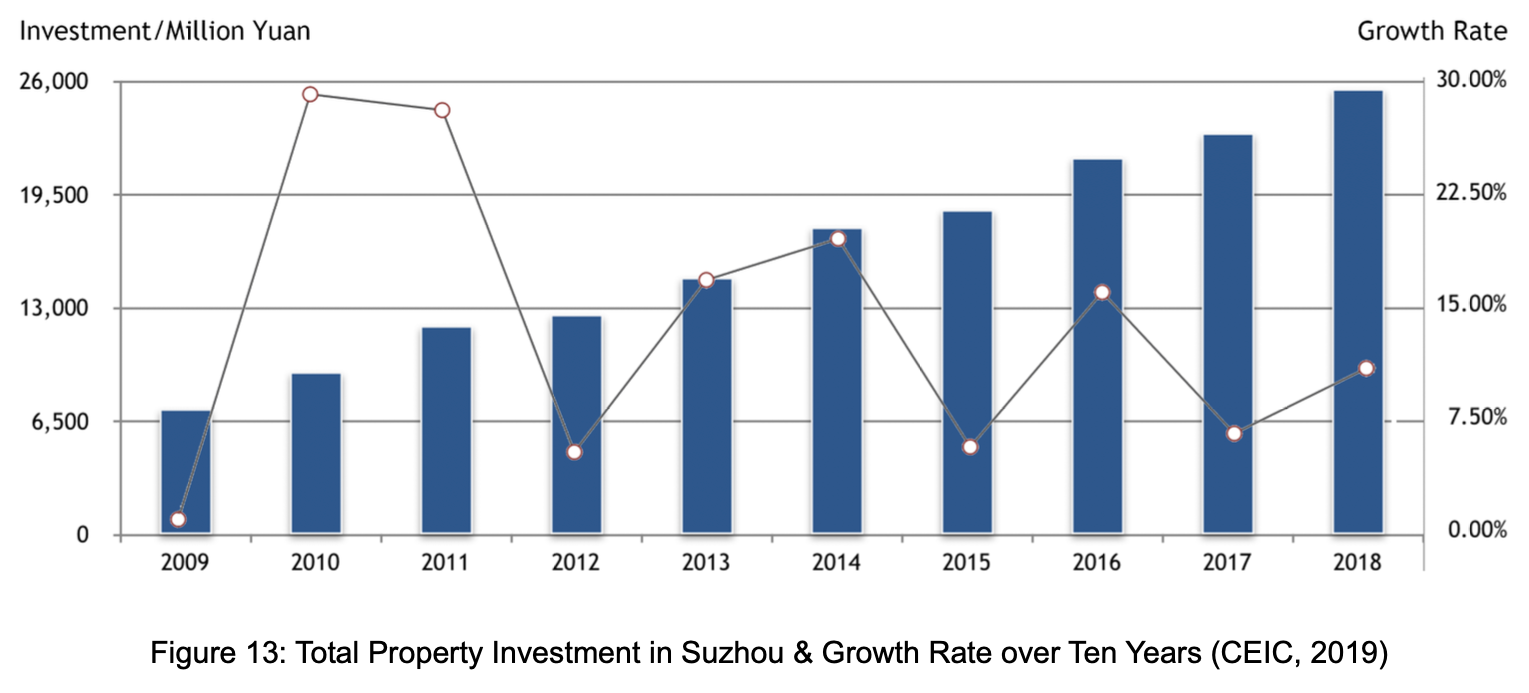

- The total property investment in Suzhou is increasing with a fluctuated growth rate, which tends to be relatively stable at around 10%.

- Total foreign investment in the property market and its proportion is generally decreasing after 2013, although there was a rebound in 2016. The foreign investment environment now is not as prosperous as the previous under the rapid development of new industrial zones.

2.2 Effect of Investment

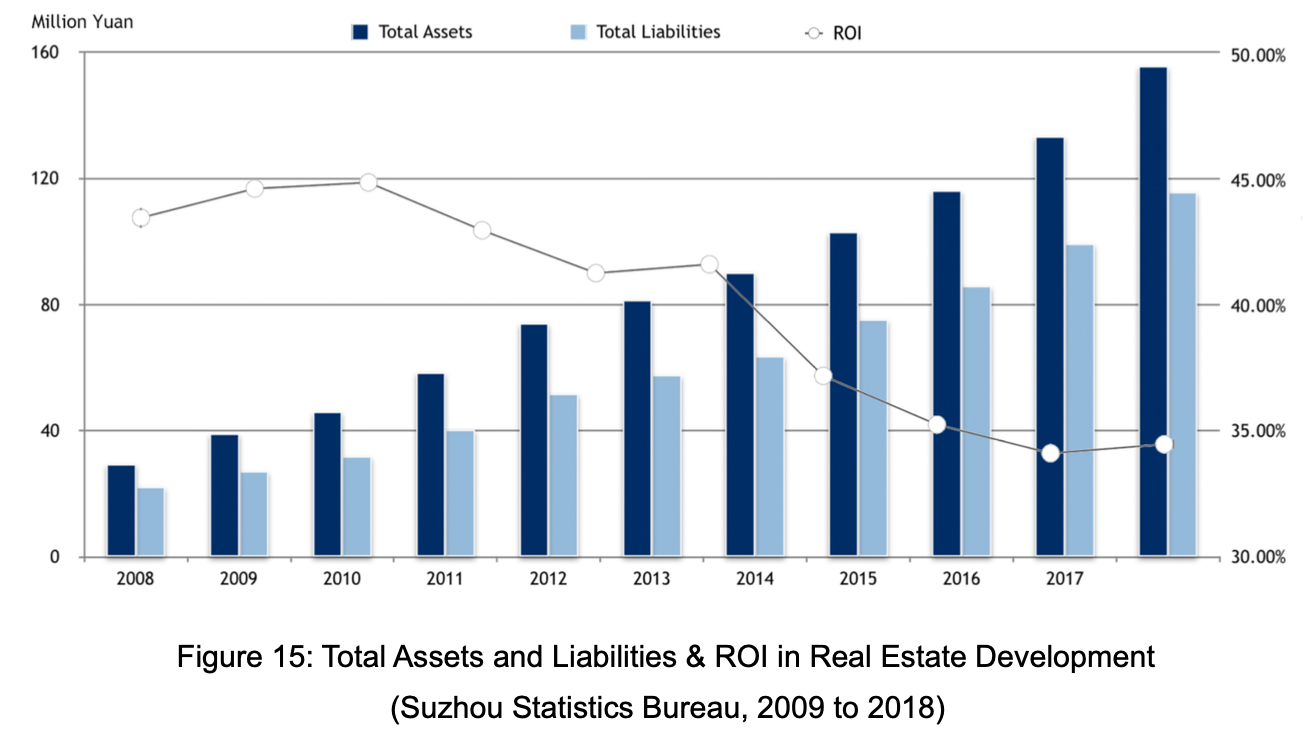

- The trend of return on investment (ROI) is decreasing in Suzhou property market.

- Calculation: ROI = (Total Assets - Total Liabilities)/Total Liabilities*100%

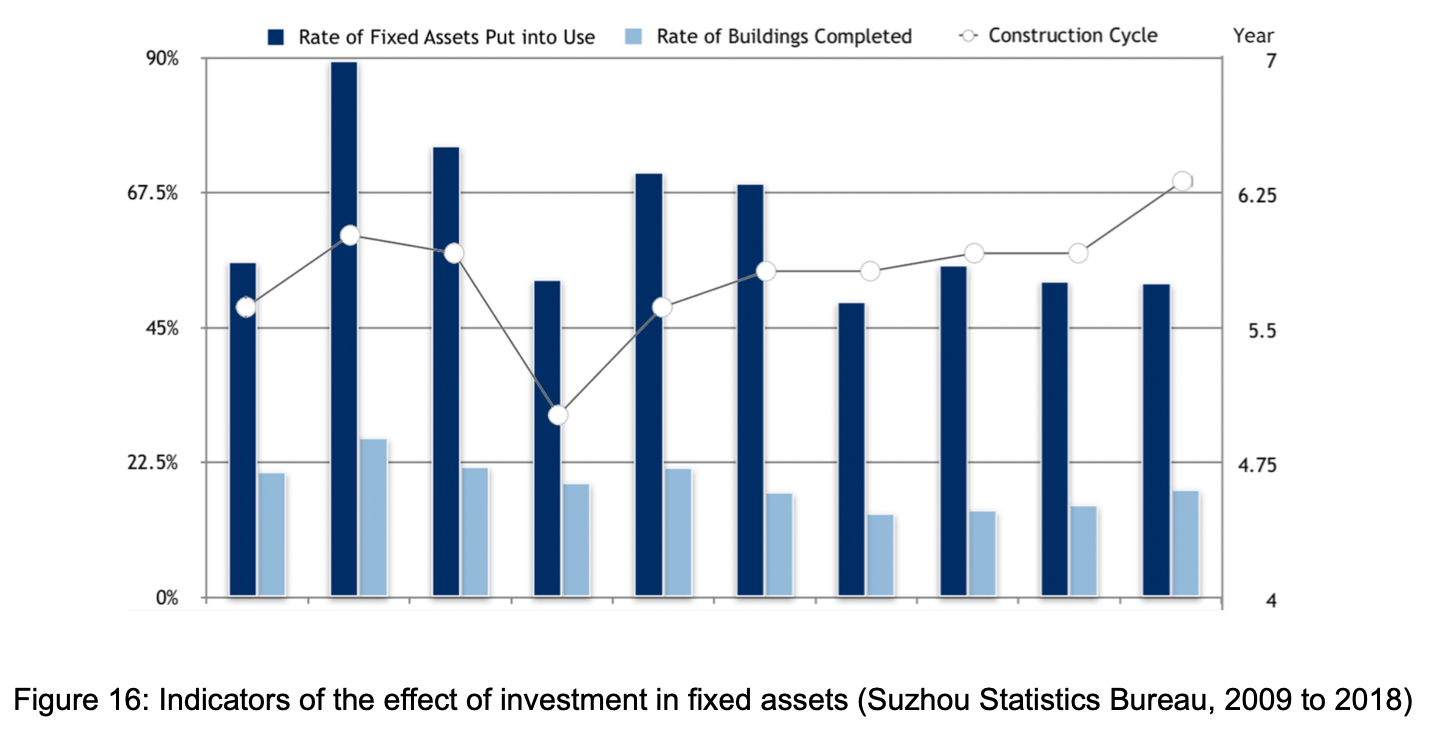

- The trend of the lower rate of fixed assets put into use and rate of buildings completed, as well as longer construction cycle, all indicate a higher risk for property development.

2.3 Land Market

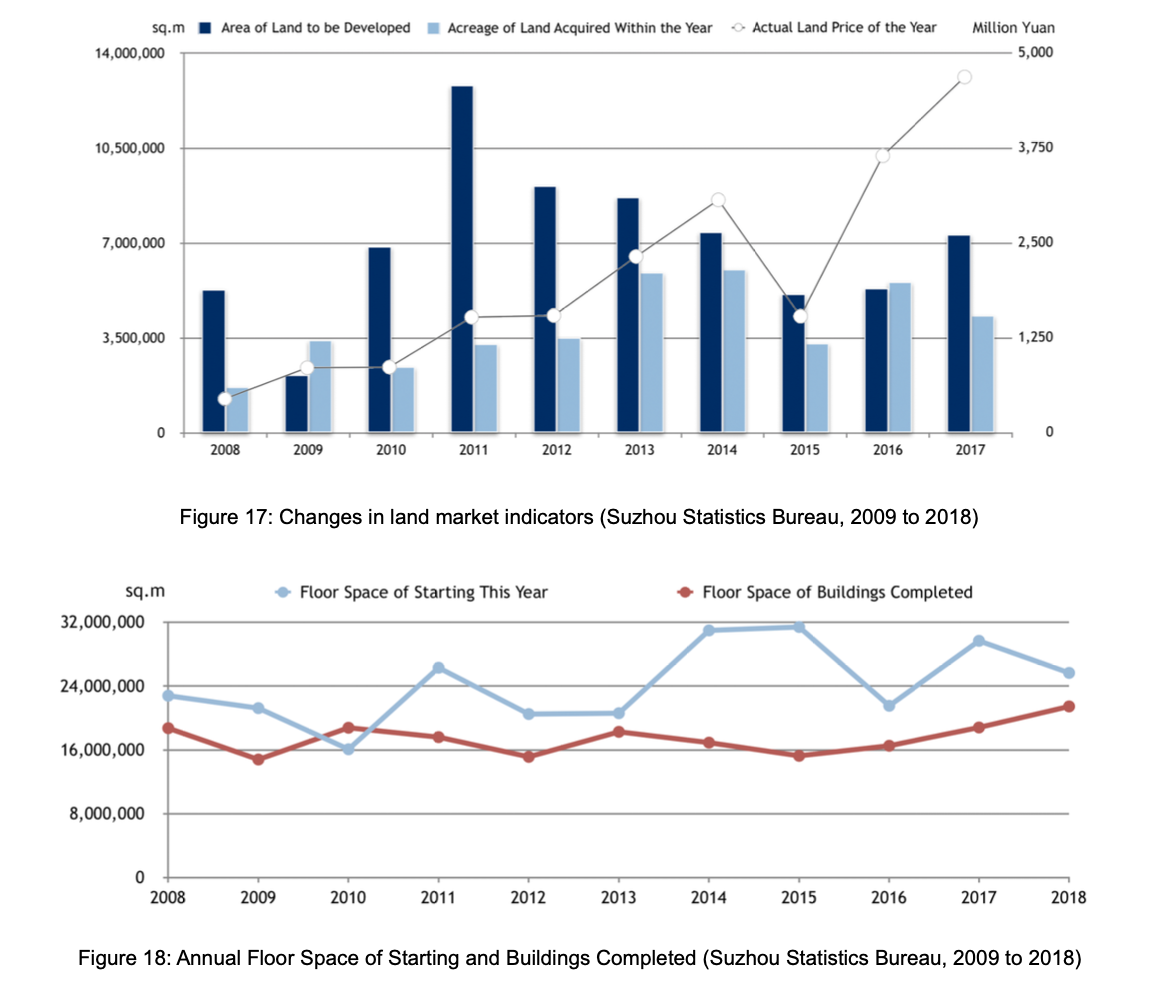

- Figure 17 & 18 shows that the land development in Suzhou is at a relatively high level, even though the first and second-tier cities are experiencing a slower rate of growth because of lack of land supply (Ouyang, 2017).

- The data of the area of land to be developed and the gap between floor space of starting and buildings completed indicates that the inventory of land remains to be consumed.

2.4 Housing Market

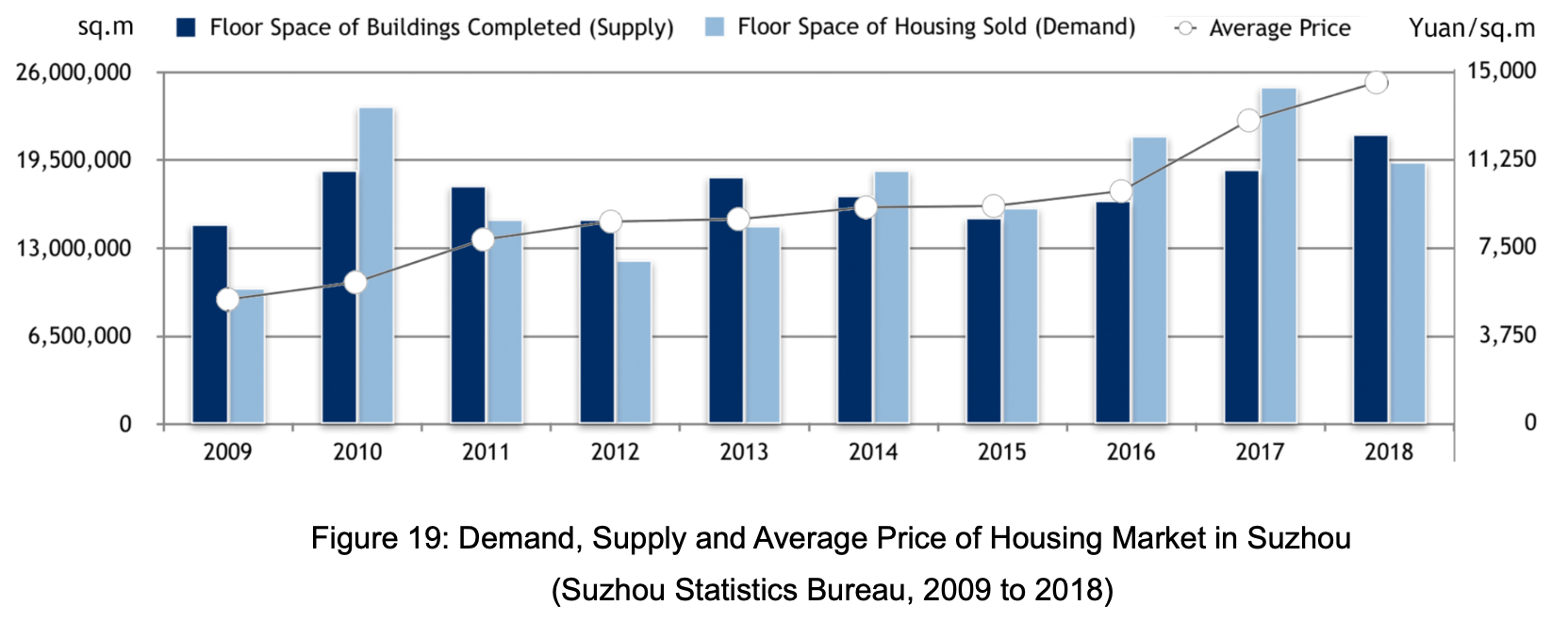

- After 2014, the supply of housing market is not adequate to the demand, and the average price is rising quickly with a growth rate of 29% in 2017 and 12% in 2018.

- 2017 is a year with a property boom, while the real market will tend to be cool down in the following years with both government regulation and market forces.

3. Status, characteristics and potential of sub-markets

3.1 Residential Building Market

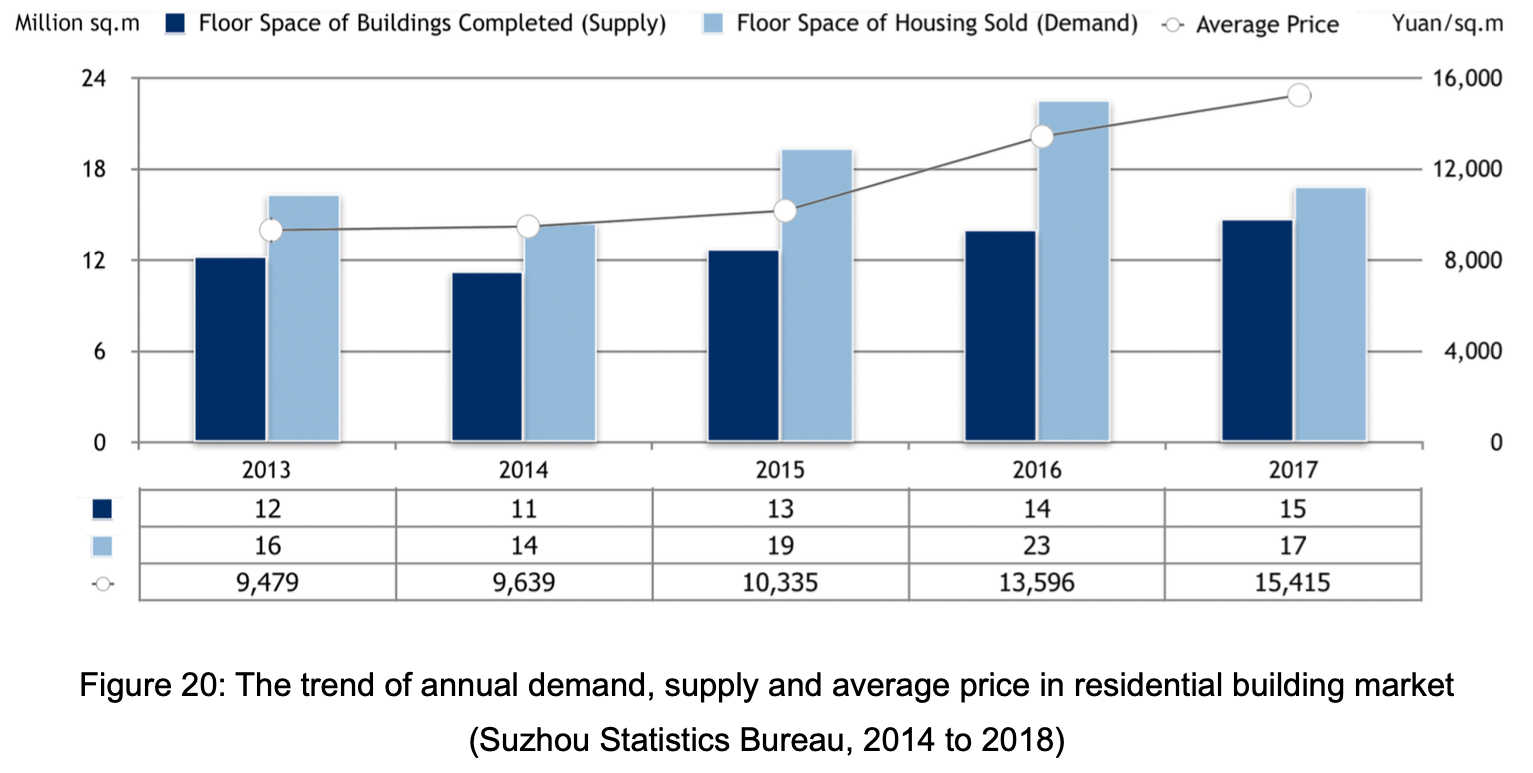

3.1.1 Annual Trend

- The overall residential housing market shows that the supply falls short of the demand.

- In 2017, the trading volume had a significant decline of 25% compared with 2016.

- The housing price increased rapidly in 2016 with 32% growth rate.

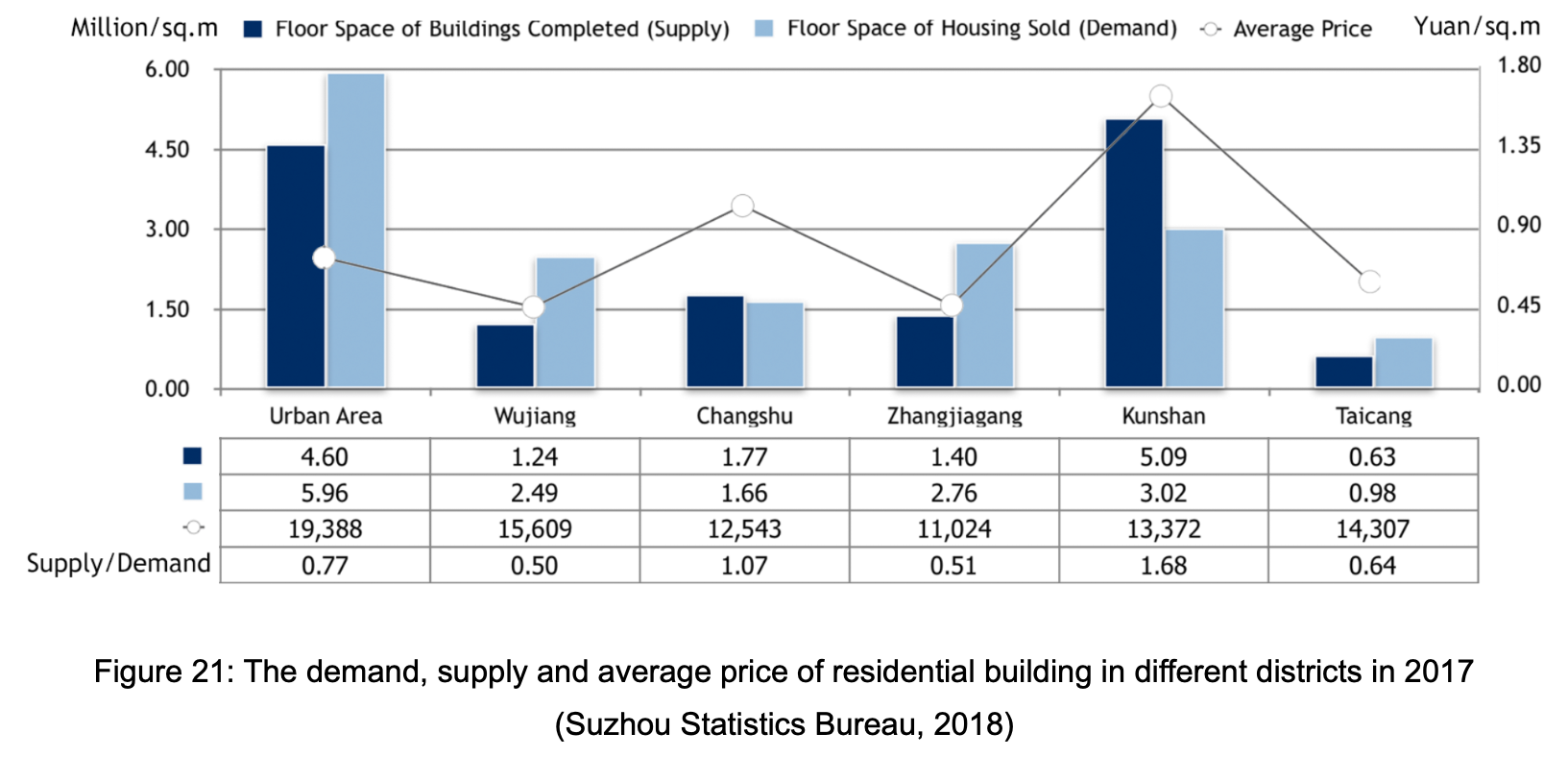

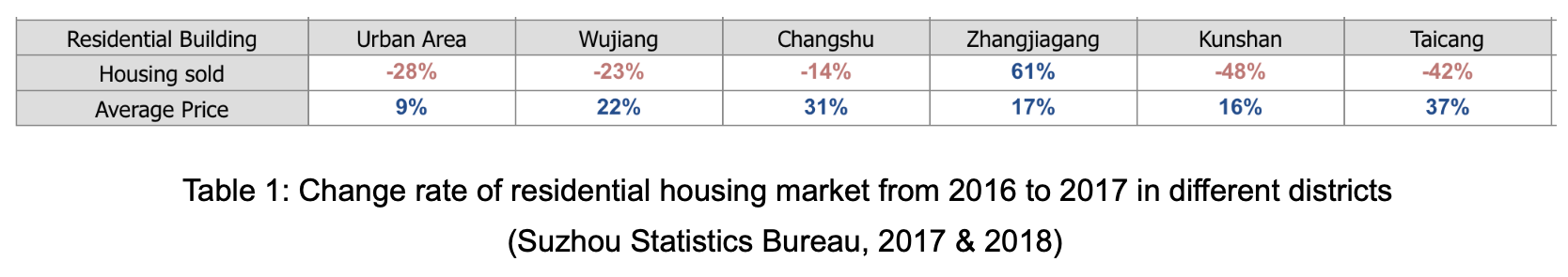

3.1.2 District Situation

- Wujiang and Zhangjiagang have lowest supply-demand ratio of 50%, while the supply in Kunshan greatly exceeds the demand.

- The housing sales volume decreased sharply in most districts, except Zhangjiagang.

- Changshu and Taicang had obvious increases in average price.

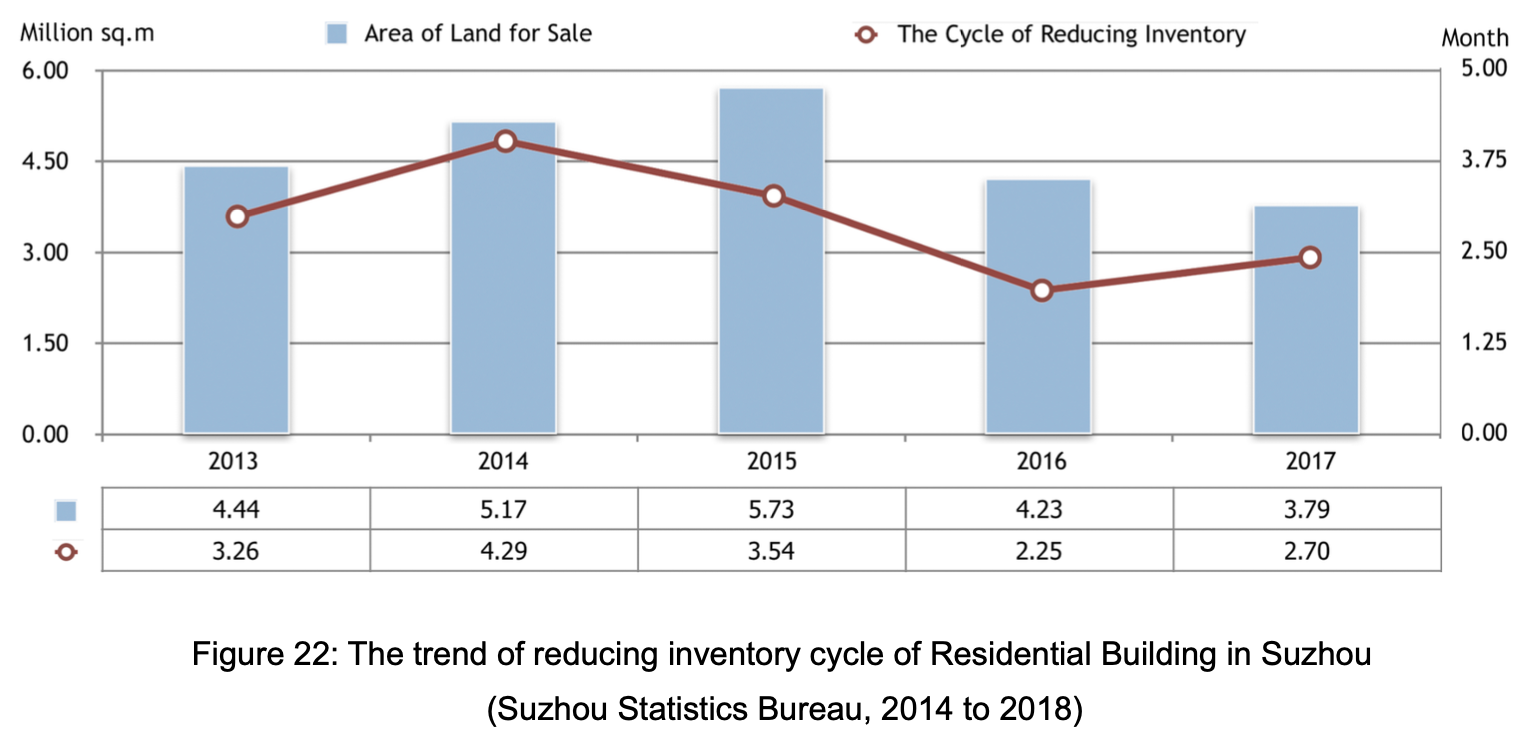

3.1.3 The cycle of reducing inventory

- The cycle of reducing residential housing inventory is relatively short and decreasing, which means the market tends to be stable and healthy.

- The cycle of reducing inventory = Area of land for sale / monthly average sales (Xu, et al.,

- The inventory of residential housing was mainly concentrated on urban area, while the districts with inventory pressure were Kunshan and Taicang.

3.2 Commercial Property Market

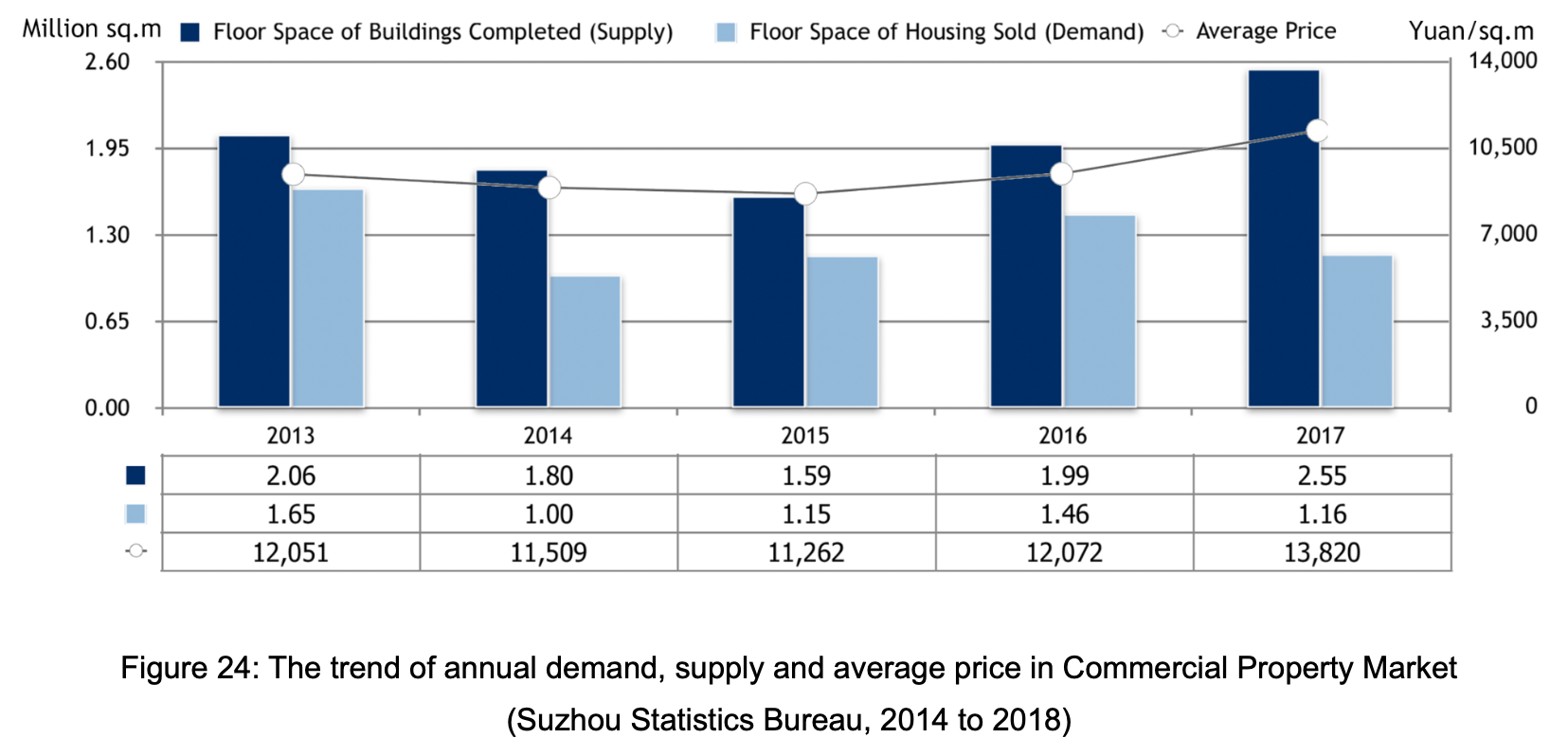

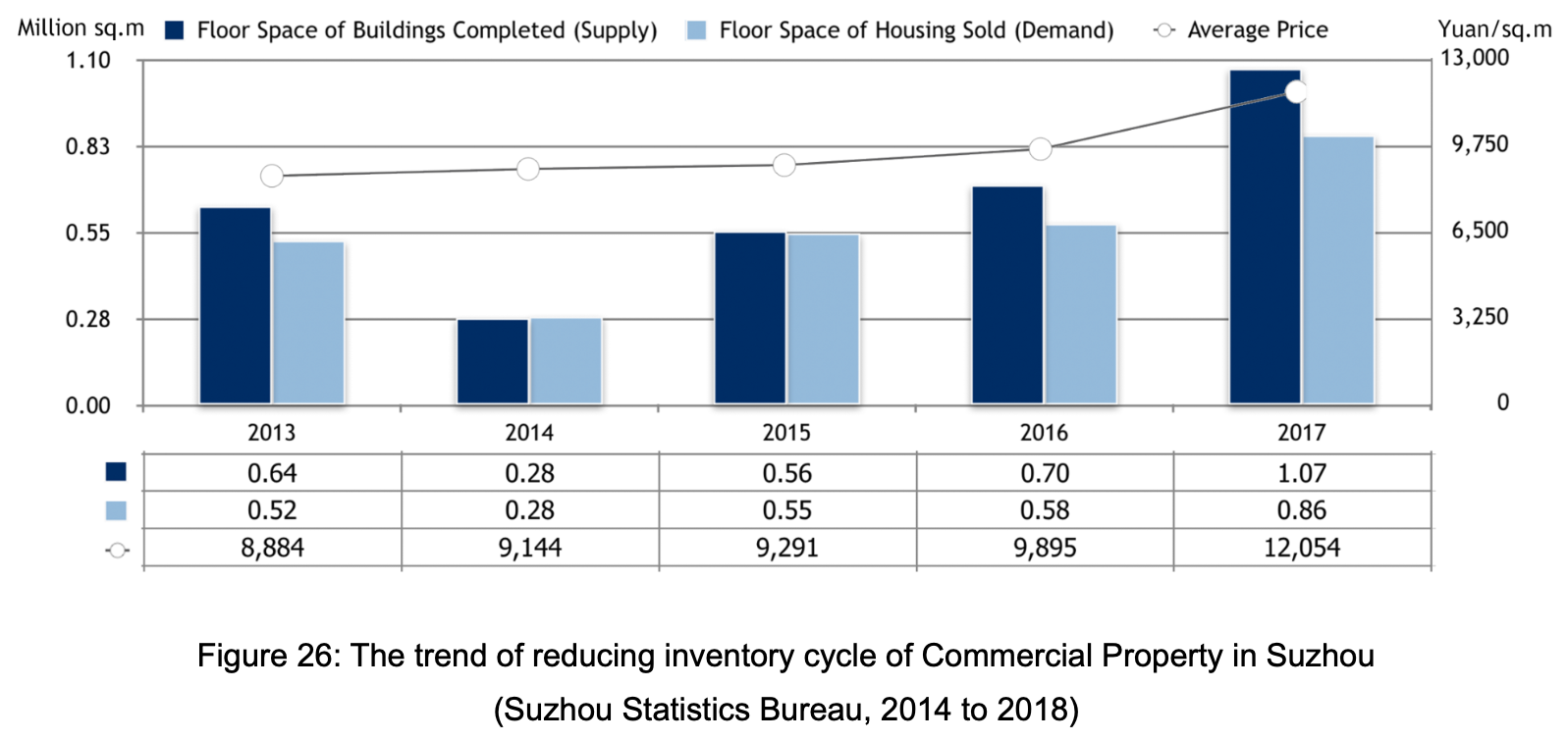

3.2.1 Annual Trend

- The commercial property market is saturated, and the supply was even more than twice the demand in 2017.

3.2.2 District Situation

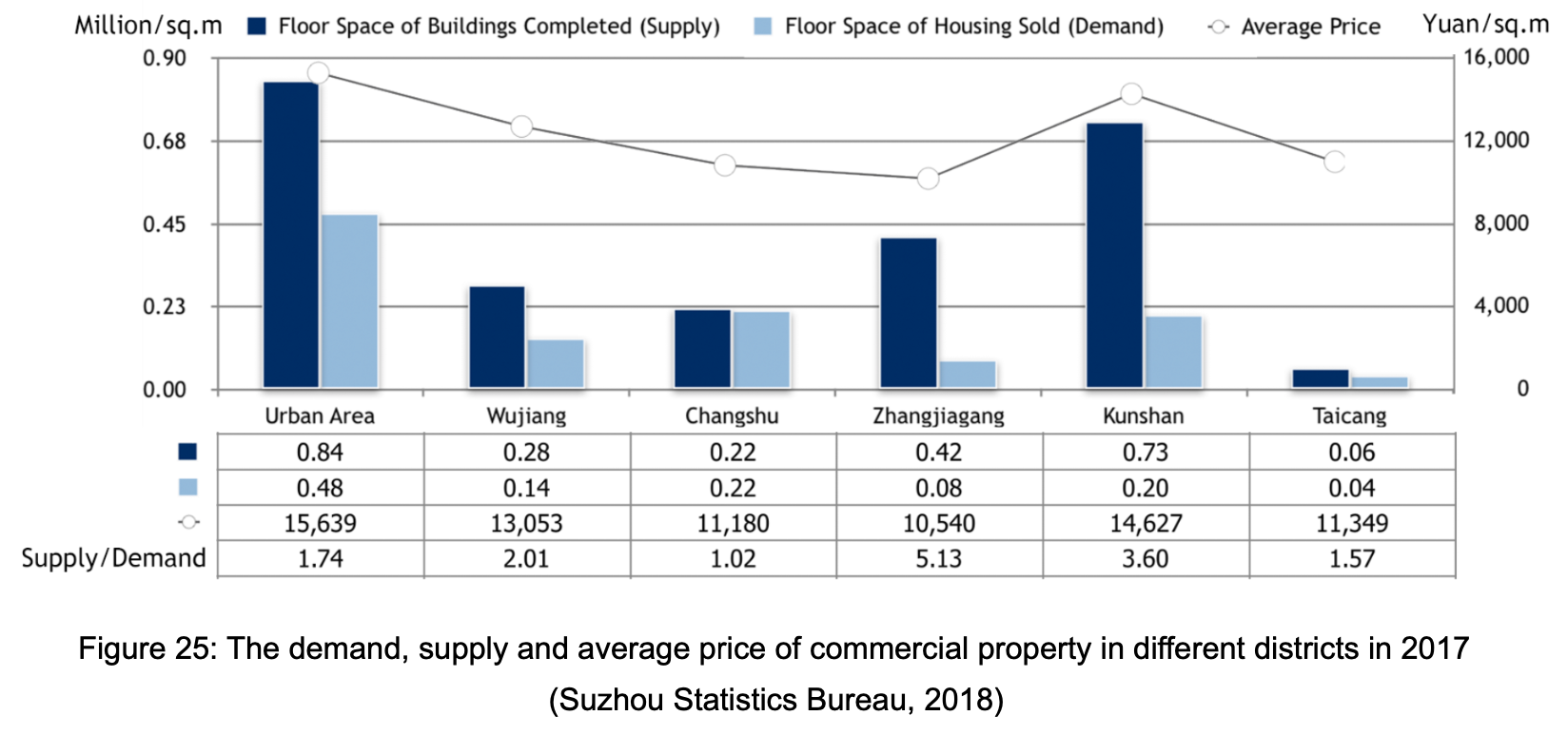

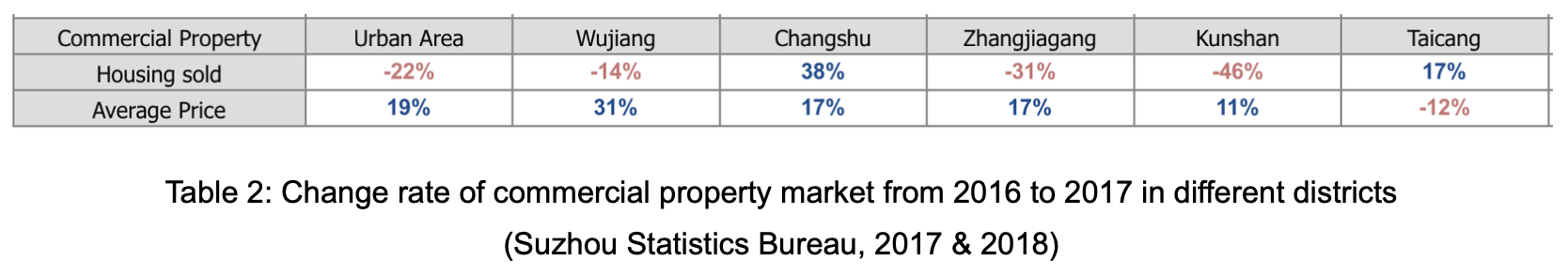

- The commercial property market is overheating, especially in Zhangjiagang and Kunshan.

- Only Changshu and Taicang reached a balance between supply and demand in commercial property market with a positive increase of sales volume in 2017.

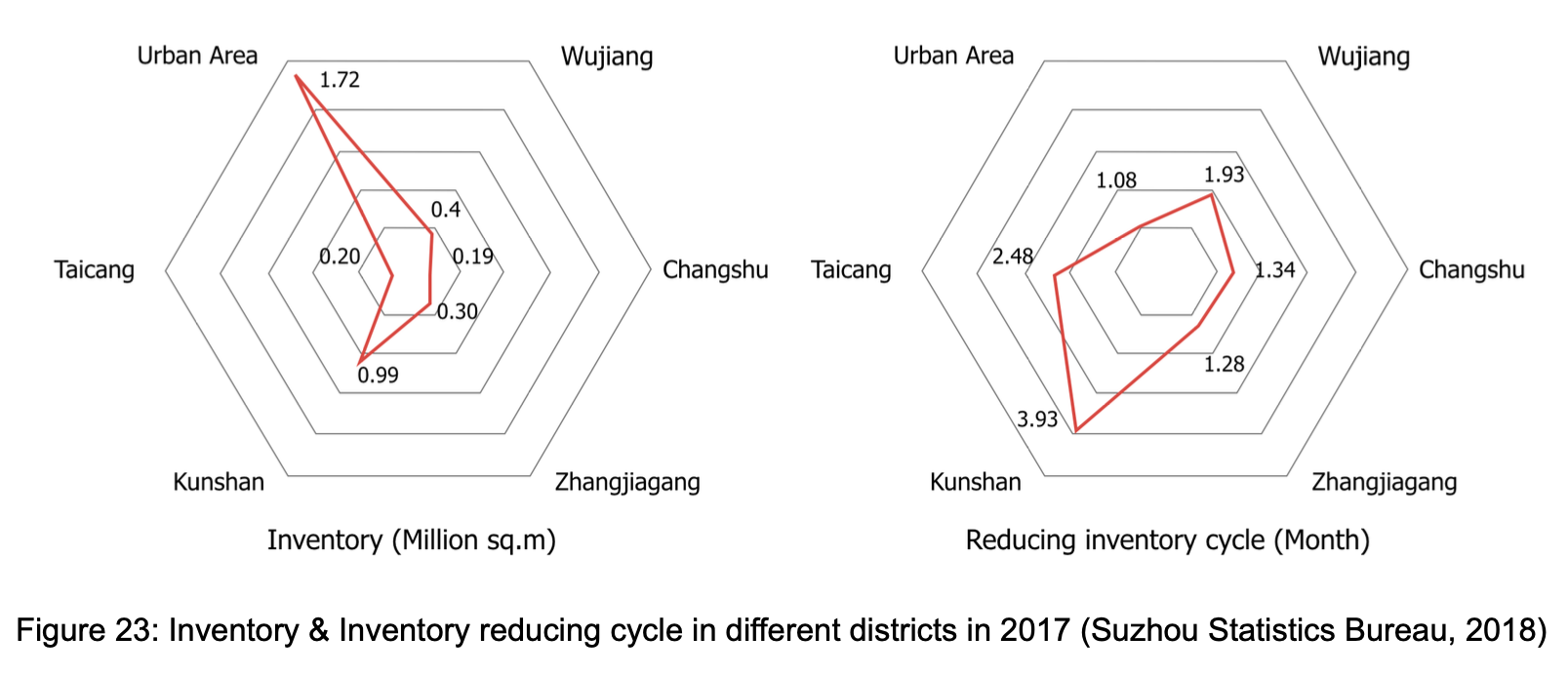

3.2.3 The cycle of reducing inventory

- The cycle of reducing commercial property inventory is approximately 30 months, which causes high pressure on the market.

3.3 Office Building Market

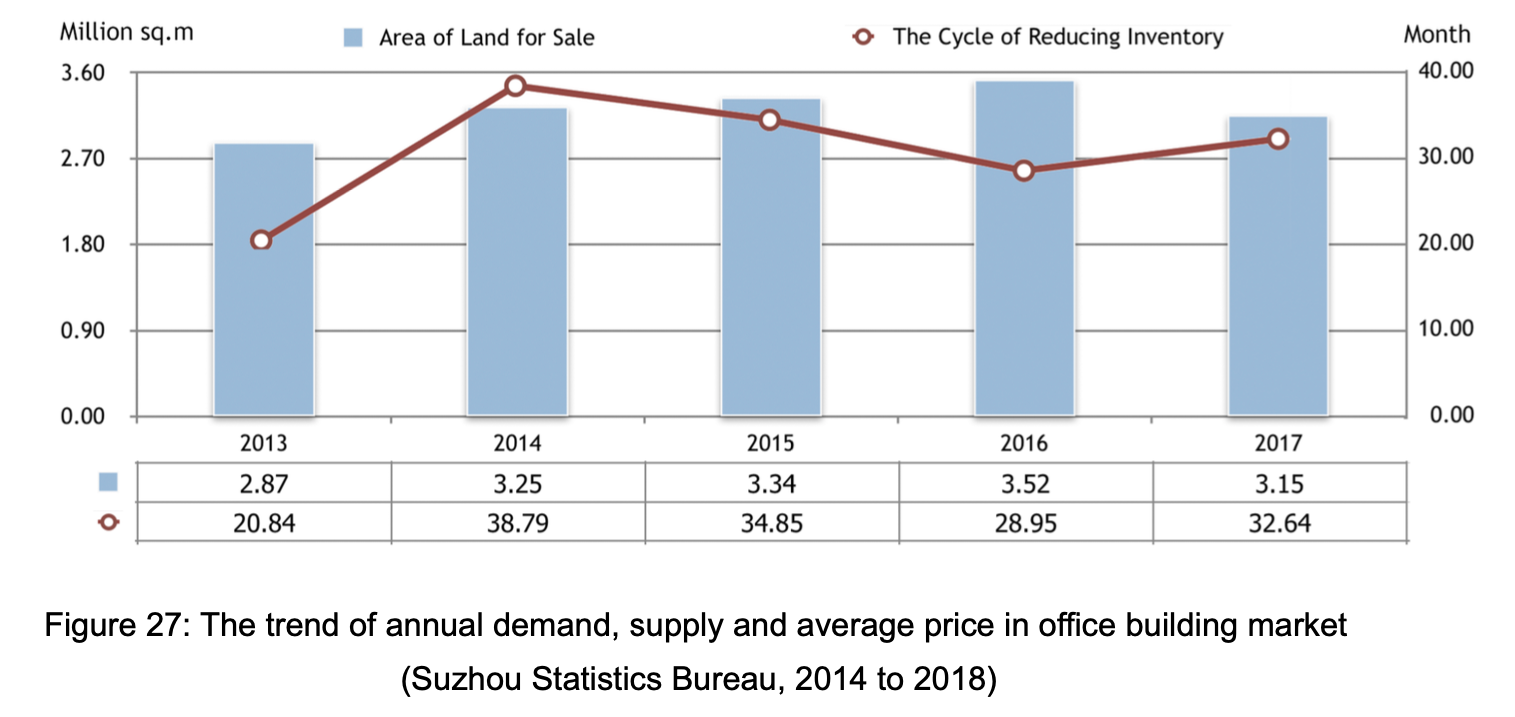

3.3.1 Annual Trend

- The supply-demand ratio of is increasing, and the office building market tends to be saturated in the following years.

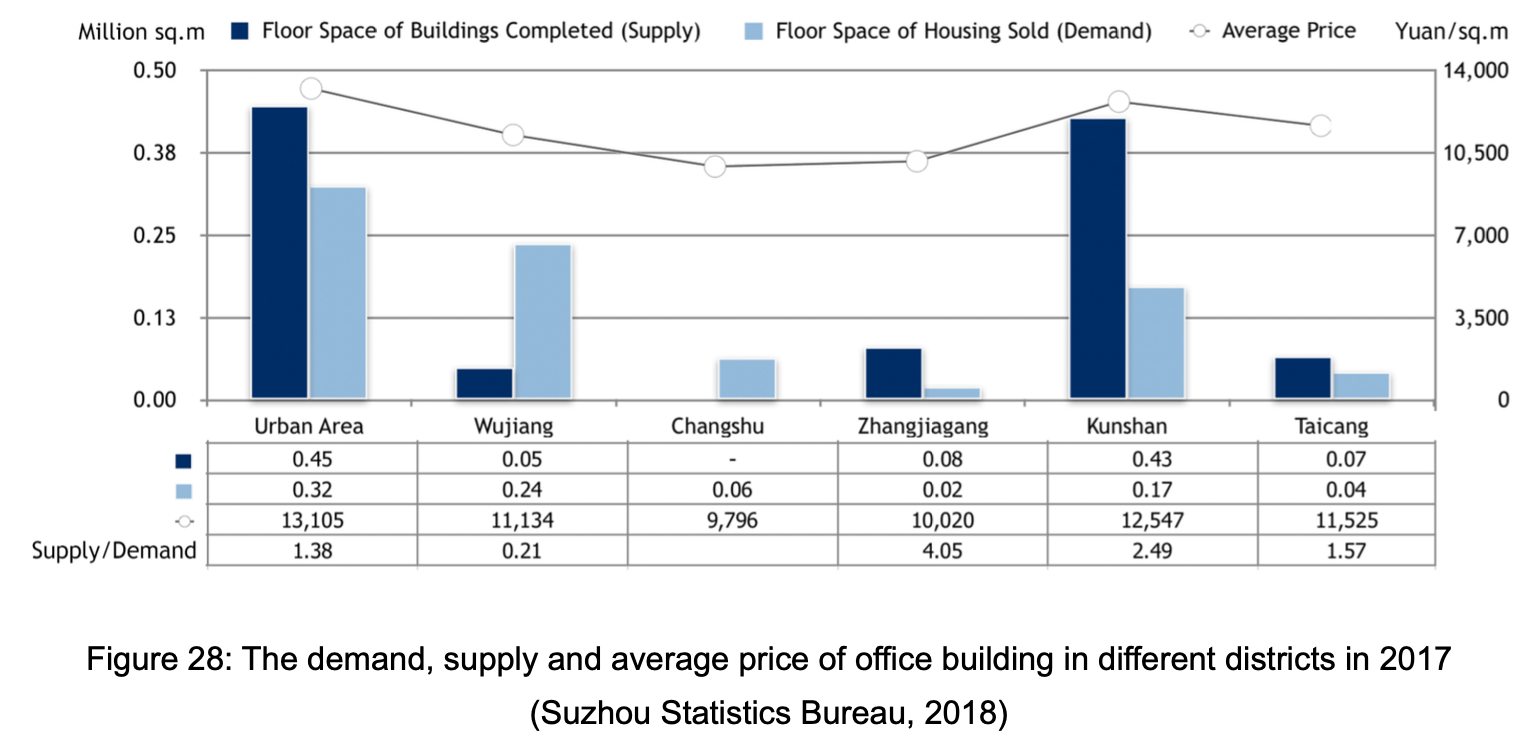

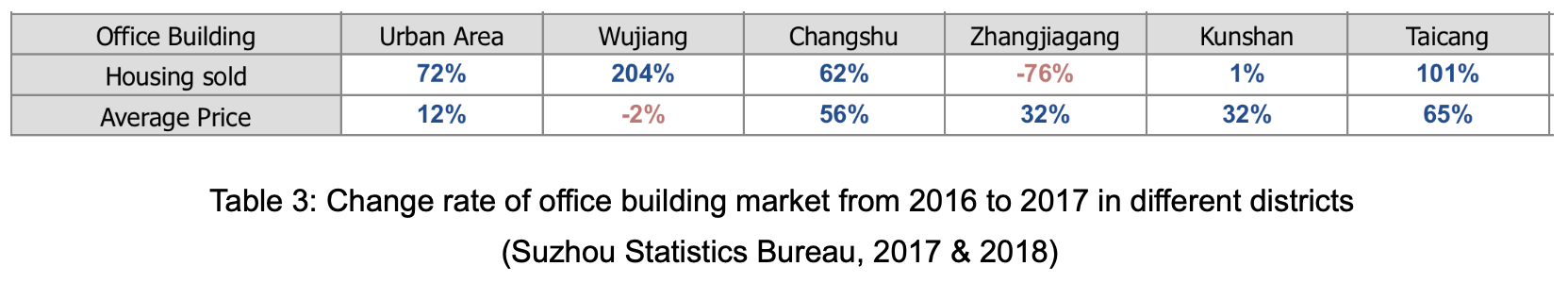

3.3.2 District Situation

- The relation between supply and demand of office building is imbalanced among different districts. The market of Zhangjiagang and Kunshan are over-saturated, while the supply in Wujiang can hardly keep pace with the demand.

- The office housing sold in Wujiang experienced a dramatic increase in 2017 that the supply cannot satisfied it. However, the average price was slightly declined in Wujiang.

- The sales volume of office building in Zhangjiagang had a huge drop in 2017, although the overall market was booming.

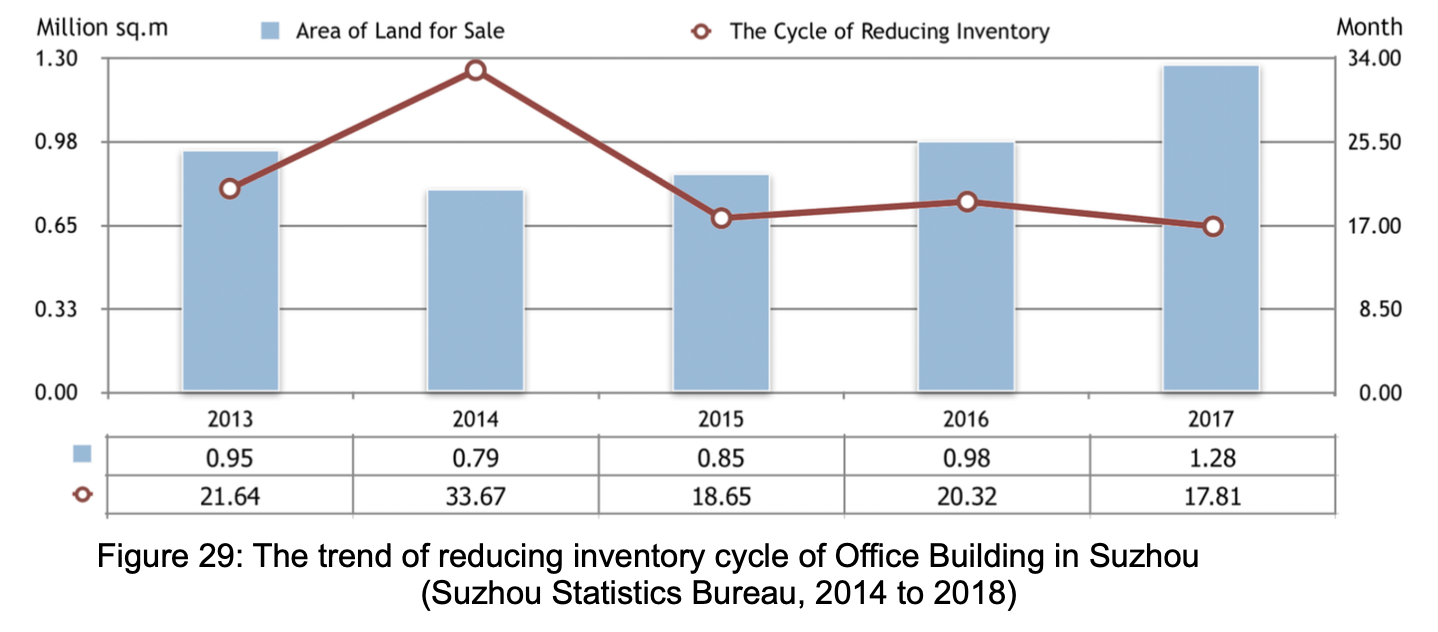

3.3.3 The cycle of reducing inventory

- Although the area of land for sale is increasing, the cycle of reducing inventory has a trend of decline. Nevertheless, the cycle is still too long.

4. Influential factors to market trends and opportunities

4.1 Policy Factor

The national regulatory policies are continued implementing on real estate market in 2019 and the housing market is likely to continue declining in the next two years. However, with the introduction of real estate tax, the real estate mechanism dominated by market regulation will take a dominant position, and the administrative measures will gradually disappear.

The policies of restrictions on sales and purchases in Suzhou are updated in 2019, which will cool down the property market and promote a stable development. The investment of developers will be more rational rather than speculative. In addition, Suzhou Industrial Part published documents for improving the environment of foreign investment in July 2019.

4.2 Economic Factor

According to the future city development plans and the integration development in Yangtze River Delta, especially the integrated transportation plan, Suzhou has huge potential to usher in a new substantial economic growth in the next few years. The rapid growth rate of GDP per capital (9.6% in 2017) and per capital disposable income also indicate a higher purchasing power.

However, the international and national economic situation is facing several challenges during recent years, and potential changes are likely to have impacts on property market, such as the trade war between China and America.

4.3 Social Factor

Both national and local governments have published policies related to the introduction of qualified talents and relaxed the requirements for household registration in 2019, which means the population will continue growing in Suzhou and the rigid demand will promote the real estate market.

5. Recommendations

Although the overall property market is not prosperous, Suzhou still has investment potential due to the future development plans, strong economy and attractiveness of talents. The sub- market suggested to invest is residential building because the current supply is unable to meet the demand and the rigid demand guarantee a relatively low risk of investment, while the commercial property and office building market are both overheating during recent years. The district recommended to invest is Suzhou Industrial Park in urban area due to a series of positive policies for foreign investment and talent introduction.

However, under the strict regulations on property market, developers should be cautious when entering the market. It is probably a suitable time to enter the market over the next few months in a downturn period with lower cost, because the construction cycle of residential buildings is around six years. During this period, it is important to pay attention to new policies and adjust strategies promptly since the property market in China is highly intervened by the government.

Due to the limitation of access to information, the data analyzed in this report is not updated, which may cause inaccurate forecast to some extent.

Reference List:

CBN (2019) The official list of new first-tier cities in 2019 has been released. [Online] Available from: https://www.yicai.com/news/100200192.html (Accessed: 23th October, 2019)

CEIC (2019) China Premium Database. [Online] Available from: https://insights-ceicdata-com.ez.xjtlu.edu.cn/Untitled-insight/views (Accessed: 23th October, 2019)

China Index Academy (2019) Real estate policy in China in the first half of 2019. [Online] Available from: https://fdc.fang.com/report/12479.htm (Accessed: 23th October, 2019)

CSCF (2017) Suzhou starts to compile a new round of urban master plan (2040). [Online] Available from: http://www.chinasmartcity.org/detail.asp?id=22598 (Accessed: 23th October, 2019)

Jiangsu Urban & Rural Planning (2015) Urban system planning of Jiangsu province (2015-2030) approved by the State Council. [Online] Available from: http://www.jsurp.org/jscsgh/infodetail/?infoid=ee2ccc59-6064-4135-aeee-93aae49df07a (Accessed: 23th October, 2019)

Ouyang, J. (2017) ‘Housing market forecast and response in the next three years’, Urban Development’, (6), pp. 45-47. [Online] Available from: http://www.wanfangdata.com.cn.ez.xjtlu.edu.cn/details/detail.do?_type=perio&id=cskf201706016 (Accessed: 23th October, 2019)

Park, J., Ryu, D. & Lee, K. (2019) ‘What determines the economic size of a nation in the world: Determinants of a nation’s share in world GDP vs. per capita GDP’, Structural Change and Economic Dynamics, (51), pp. 203-214. [Online] Available from: https://www.sciencedirect.com/science/article/pii/S0954349X18302856 (Accessed: 23th October, 2019)

Qi, Y. (2012) ‘Macro environment analysis of China’s real estate market — based on PEST analysis’, Economic Research’, (31), p.50. [Online] Available from: http://www.wanfangdata.com.cn.ez.xjtlu.edu.cn/details/detail.do?_type=perio&id=sq-zh201231037 (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2009) 2009 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2009/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2010) 2010 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2010/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2011) 2011 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2011/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2012) 2012 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2012/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2013) 2013 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2013/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2014) 2014 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2014/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2015) 2015 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2015/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2016) 2016 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2016/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2017) 2017 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2017/indexch.htm (Accessed: 23th October, 2019)

Suzhou Statistics Bureau (2018) 2018 Suzhou statistical yearbook. [Online] Available from: http://www.sztjj.gov.cn/SztjjGzw/tjnj/2018/indexch.htm (Accessed: 23th October, 2019)

The State Council (2016) Reply of the State Council on the Master Plan of Suzhou. [Online] Available from: http://www.gov.cn/zhengce/content/2016-08/02/content_5096891.htm (Accessed: 23th October, 2019)

Wang, L. Shen, J. & Chung, C. K. L. (2015) ‘City profile: Suzhou - a Chinese city under transformation’, Cities, (44), pp. 60 - 72 [Online] Availablefrom: https://www.sciencedirect.com/science/article/pii/S026427511400208X (Accessed: 23th October, 2019)

Xu, et al. (2017) ‘Inventory Definition and the Cycle of Reducing Inventory of Urban Commercial Houses—Taking the Cities of Yangtze River Delta as an Example’, Natural Resource Economice of China, 30(7), pp.60-64. [Online] Available from: http://www.wanfangdata.com.cn.ez.xjtlu.edu.cn/details/detail.do?_type=perio&id=zgdzkcjj201707013 (Accessed: 23th October, 2019)